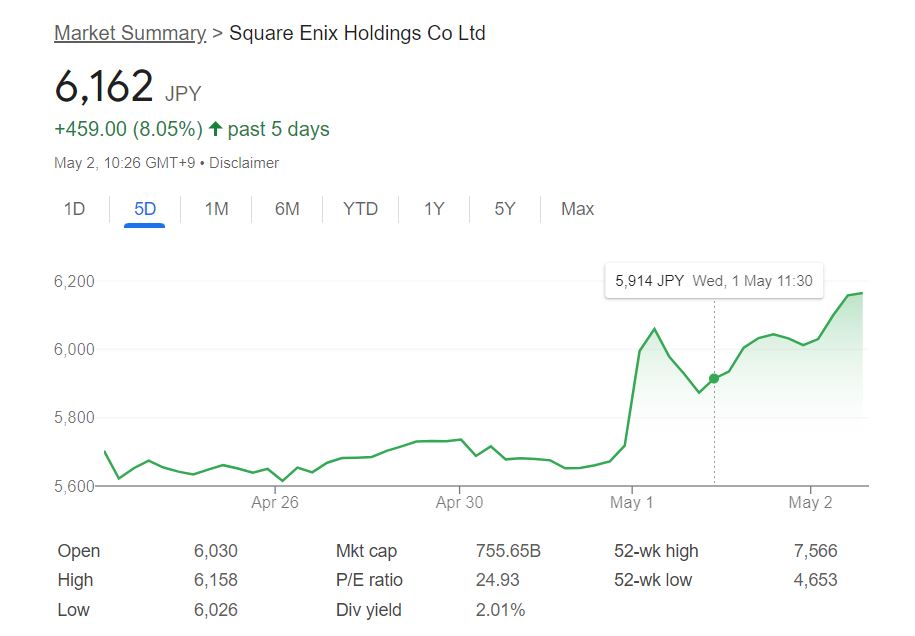

As the stock market opened on May 1, Square Enix’s stock price hit 6,012 yen, rising by 5.14% compared to the previous day. It seems that shareholders’ high expectations of Square Enix outweigh the company’s recently announced losses, or as The Nikkei puts it, they feel that “all the bad news has been exhausted.”

The surge in Square Enix’s stock value came the day after the company announced that they expect an extraordinary loss of 22.1 billion yen (approx. $140 million based on recent conversion rates) in the fiscal year ending March 31, 2024 (Related article). The loss comes as a result of a policy change that was introduced on March 27, whereby the company decided to reallocate and refocus their development resources. This resulted in the discontinuation of titles in development, bringing about production cost-related losses and other expenses.

Although Square Enix did not name a specific title or clarify if they cancelled one or multiple games, their use of the term “HD game” (which they usually use to refer to console games, as opposed to mobile or online games) as well as the implied large scale of the project, caused concern among fans about the fate of Dragon Quest 12. There has been little information about Dragon Quest 12 since it was first announced in May 2021, and it was recently reported that Square Enix’s Yu Miyake would be leaving his position as Dragon Quest series producer (Related article).

Regardless of what titles Square Enix has decided to abandon, their actions seem to be consistent with comments made by CEO Takashi Kiryu in November last year. The freshly appointed CEO called for a more selective and concentrated approach to the allocation of Square Enix’s development resources. He also suggested that the company had grown too dependent on strong IPs such as Final Fantasy and Dragon Quest, leading to a lack of diversity in their portfolio. At the time, the company expressed regret at having made too many titles that “fall somewhere between” AAA and indie games, indicating their intent to narrow down their game lineup in the future.

Shareholders seem to have high expectations of Square Enix’s upgraded policy and future endeavors, which is apparent from the company’s rising stock price. Square Enix’s stock price rose by 5.14% on May 1, and is climbing by an additional 2.51% at the time of writing.

I would be putting my bets on Square Enix as well. It will take time for Kiryu’s decisions to come to the forefront. But i do think with a move toward A.I Translations, using it in some workflow, along with the approach to be multiplatform with a focus on PC first and away from self censorship from the Ethics Committee. Square Enix will easily return back to normal. Bonus points if they do end up making their own in-house engine for next generation and somehow Verum Rex is involved with being the first use of A.I Translation. That will just catapult them past everyone else.