A Wall Street Journal report from last month brought attention to market research that indicates Zoomers in the US are spending a lot less on video games in 2025 than they did in 2024. Data from the research firm Circana indicated that spending on games from January to April 2025 fell by 13% year-on-year among Americans aged 18 to 24, while weekly spending on video games dropped by about 25% from 2024 levels. While it is not as dramatic as in the US, a similar downward trend in interest and spending can be seen among Gen Z in Japan in the past few years.

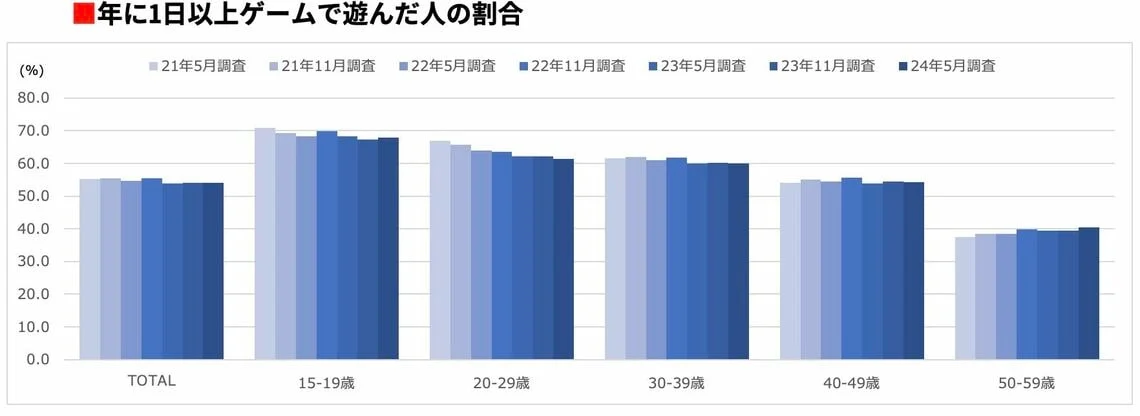

According to a survey by marketing research firm Intage, the proportion of Japanese people who played videos games at least once a year in the 15-19 and 20-29 age brackets has been on a downward trend in recent years (source: Toyo Keizai Online). The gradual decrease in interest between 2021 and 2024 is especially pronounced among people in their 20s.

A separate 2023 survey by the marketing division of SHIBUYA109 Entertainment looked specifically at Japanese Zoomers’ attitudes toward gaming. Among respondents aged 15-24 who play games, the average daily play time was around 100 minutes, and average yearly spending was about $70. However, a majority (55.1%) of the age bracket identified as idle/casual players, and the average yearly spending among them was about $42. This group showed a strong preference for smartphones over consoles and PC, which suggests they are favoring free-to-play titles over purchasing full-price games.

In the case of the US, The Wall Street Journal cites factors like the cooling job market, the burden of student loans, and rising credit card delinquency rates as reasons why young people are spending less on games (and hobbies in general). By comparison, Japan’s employment situation is less severe. As of June 2025, the unemployment rate stood at 2.5%, compared to 4.1% in the US, and the jobs-to-applicants ratio remained steady at 1.24. This suggests that Gen Z in Japan are under less economic pressure than their American counterparts (Statistics Bureau of Japan).

On the other hand, in Japan, there is a growing awareness of “time performance” or “taipa” – the balance of time spent vs. value gained from consuming content – among Zoomers. Survey results from Intage indicate that Gen Z tends to multitask when interacting with content more so than other generations, with a stronger awareness about how much they’re benefiting from the time they’re investing. As free-to-play titles require a smaller initial investment than full-price games and can be consumed during idle time (while commuting to school or work), this might be a factor behind the drop in money and time spent on games among Japanese youth.

Meanwhile, development costs of full-priced games continue to rise, and there’s increasing discussion about potential pricing hikes across the industry. Combined with declining game spending across different markets, this could make full-priced games an even tougher sell for Gen Z.

I wonder would spending would go up if there were more premium mobile games instead of free to play ones? $42 could get you a full length RPG by square enix on android.

Not really. Square Enix, Capcom, Sega, etc. have been porting their games onto mobile for over two decades now. Even when they did it the most, which was during the late 90s and early 10s, I still don’t think they earned more than something like Puzzle & Dragon made.

I can only see two benefits for the continued existence of these mobile ports: lessening the studios’ dependence on Windows, Steam, etc. and the tiny group of people who own an Android-based handheld console have something to play with.

This report really isn’t anything new, really. Young people with little money and a lot of free time have always gravitated toward free-to-play games, where they can just spend $10 or so every so often. It happened during the MMO boom, and it is happening now with games like Fortnite. And you also have got the cohort of salarymen who play almost exclusively games that they can enjoy during what little free time they have at home and during commute. It’s not wonder that free-to-play games attract so many people.