Capcom published financial statements for the April-June 2025 period on July 30. Although the report cited significant quarterly increases in revenue (up 54% year-on-year) and operating profit (up 91% year-on-year), Capcom saw its share price plummet (down 9.45%) on the Tokyo Stock Exchange as soon as trading started on the morning of July 31.

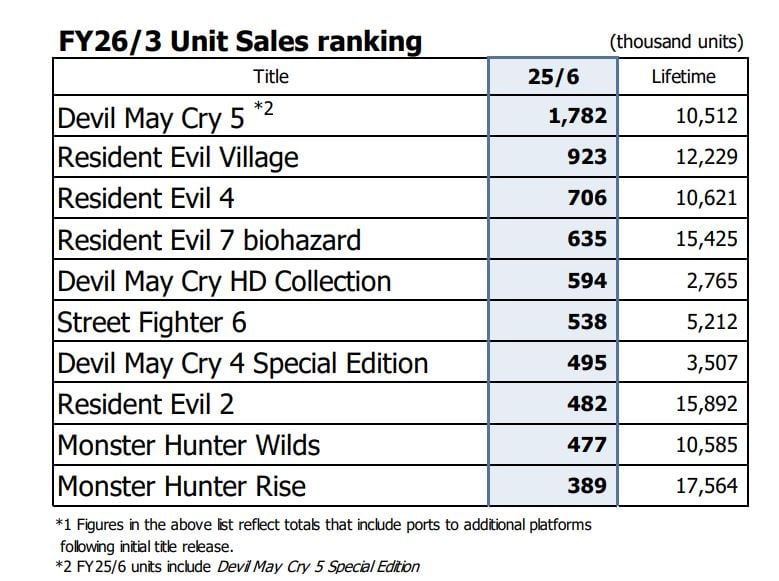

GameBiz.jp points out that the sharp decline was likely due to market concerns caused by Monster Hunter Wilds’ lower-than-expected sales. The sales data presentation from Capcom’s earnings report shows that the new game sold 477k copies between April 1 and June 30, which the company described as “soft” performance. By comparison, 2021’s Monster Hunter Rise sold 389k units during the same period. The two titles were Capcom’s 9th and 10th best-selling titles respectively.

It should also be noted that Monster Hunter Wilds has sold a total of 10.585 million units since its launch in February 2024, but the last three months account for fewer than 500,000 copies sold – suggesting a dramatic drop in momentum.

The causes behind the dropoff are most likely players’ dissatisfaction with Monster Hunter Wilds’ endgame content, as well as performance issues on PC. Capcom has pushed forward content updates originally planned for later in the year to give players incentive to keep hunting, but with optimization issues largely persisting at the time of writing, the game is stuck with an Overwhelmingly Negative rating on Steam. Although Monster Hunter Wilds’ sales fell short of expectations in the past quarter, it remains to be seen whether future updates and improvements will get the game back on track.

Unfortunately the game was not up to par with previous entries. Rise was a great game, and it ran on everything. Chasing the best (arguably) graphics in this kind of game doesn’t always pay back. Let’s hope per a Monster Hunter Rise sequel on the Switch 2