Sony Group released its consolidated financial results for the third quarter of fiscal year 2025 on February 5, 2026. As reported by Inside, PS5 lifetime sales have now reached a significant milestone of 92.2 million units sold. However, the hardware manufacturer is now facing a new hurdle: the rising memory prices.

Sony CFO Lin Tao addressed concerns about procuring memory for the console during the earnings call presentation. According to Tao, the company is already in the position to secure the minimum amount of memory required for the year-end sales season in the next fiscal year. “Going forward, we intend to further negotiate with various suppliers to secure enough supply to meet the demand of our customers.” Tao added.

Tao said the company plans to “minimize the impact” of rising memory costs by focusing on “monetizing the installed base” and growing software and network services revenue.

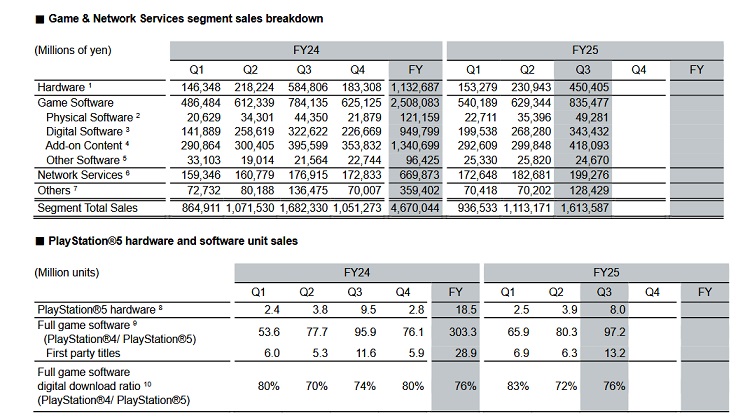

The recent software performance could suggest early signs of this strategy’s potential success. Total software sales for the PS5 and PS4 increased to 97.2 million units, up 1.3 million from last year’s same quarter (95.9 million). Digital downloads grew by 2%, accounting for 76% of all sales. The number of monthly active users on the PlayStation Network also rose to 132 million, up from 129 million in the same quarter last year.

This momentum was propelled by a 1.6 million unit surge in first-party titles sales, which reached 13.2 million units following the successful launch of Ghost of Yōtei (selling 3.3 million copies), which Tao described as a “significant contribution” to the financial results of the quarter.

Sony’s recent strategy in Japan highlights a deliberate pivot toward a digital-first ecosystem to sustain sales momentum. By late 2025, Sony introduced a Japan-exclusive “Digital Edition” of the PlayStation 5 at 55,000 yen (approx. $350 USD), strategically undercutting the price of the standard digital model. This move was Sony’s attempt to lower the barrier to entry after the significant 2024 price hikes, and incentivize a new wave of hardware adoption.

Sony’s release of the Japanese-exclusive PS5 Digital Edition at a lower price than the standard Digital Edition in late 2025 may have been a direct step toward a digital-first market, as it offered a more affordable price point following the 2024 price hikes. This shift was supported by the success of GEO’s PS5 rental service, which enabled the retailer to transition away from declining physical media and provide customers with a cheaper way to access the console.

Related articles: